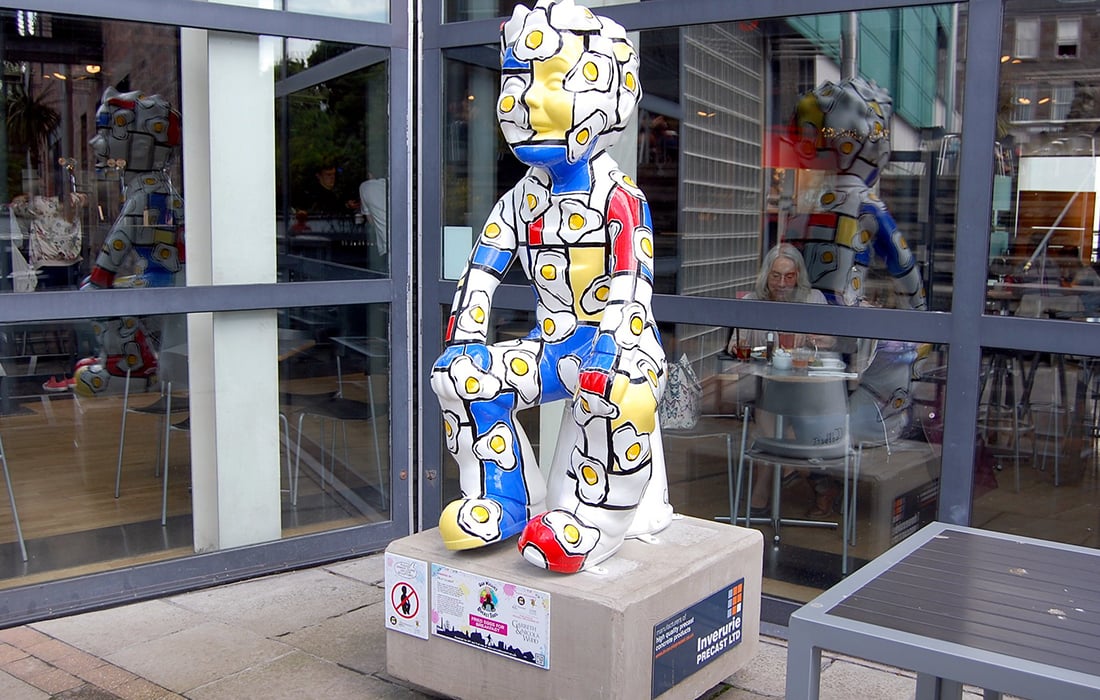

Fried Eggs for Breakfast at Dundee Contemporary Arts – a member of Future Arts Centres

Photo: Derek Hoskins (CC BY-ND 2.0)

Expand tax credits for Covid-19 recovery, MPs told

Wider application of the Theatre Tax Relief scheme would allow arts centres to reopen “within weeks”, a coalition of venues says.

Extending tax credits to more arts organisations would jumpstart the economy and save cultural life in the UK, venues say.

Future Arts Centres, a network of more than 100 venues, is lobbying MPs to expand the definition of ‘educational purpose’ in the Theatre Tax Relief scheme to include participatory work. The criterion is usually applied to Theatre in Education rather than to broader work with communities and young people.

The network’s Co-Chairs – ARC Chief Executive Annabel Turpin and Gavin Barlow, Chief Executive and Artistic Director of The Albany – say these tax credits will be “vital” to rebuilding town centres as the nation recovers from Covid-19. Changes to the scheme could be made immediately without any new legislation, they argue.

READ MORE:

The coalition could not estimate the cost of this to the Government. But Turpin said it could “make all the difference” to arts organisations and the communities they serve.

“With reduced financial risk arts centres will be able to open within weeks, with adaptable spaces that can be used for a huge range of different artistic and cultural activities,” Turpin said.

“We are ideally positioned to hit the ground running and give opportunities for artists and creators to get to work and create social, cultural and economic stimulus for our communities.”

‘Stimulate the sector’

Without a clear plan for supporting culture outside of the West End and major galleries, the sector’s economic momentum “could be lost forever,” the network claims.

It is also calling for the creation of a decentralised fund for creative industries apprenticeships and a new National Arts Project stimulus package for organisations to employ freelance artists.

Citing culture’s growing contribution to the economy, Barlow said “putting culture at the heart of local recovery makes sense socially and financially”.

“Our arts centres have provided paths to employment for young people up and down the country, and we have programmes that are ready to scale up.

“If our communities are to recover from Covid-19, we will need to look at every available opportunity to expand training and apprenticeships.”

‘Tried and tested’

Entertainment law expert Neil Adleman, Theatre Lawyer at Harbottle & Lewis, offered support for Future Arts Centre’s argument, saying that non-legislative changes to guidance around Theatre Tax Relief would benefit a wider range of artistic programming and activities.

He noted: “Theatre Tax Relief provides a tried and tested structure for delivering financial benefit to organisations across the theatre sector, which has the potential to stimulate activity and preserve both salaried and freelance roles.”

Join the Discussion

You must be logged in to post a comment.