Orchestras have been eligible for tax relief since 2016.

Photo: Peter Matthews

Who’s missing out on tax relief?

While the number of tax reliefs available to the creative industries has grown, some sectors are missing out by being slow to take advantage of potential savings. Louise Veragoo explains who might be eligible for this free cash.

Creative sector tax reliefs were introduced with the principal aim of encouraging creative investment and production within the UK while also raising the UK’s profile overseas. Over £1bn was paid out during 2018/19, with Film Tax Relief accounting for over half of this total.

In contrast, the three newest reliefs accounted for just £98m of the total – Theatre Tax Relief £78m, Orchestra Tax Relief £16m and Museums and Galleries Exhibition Tax Relief (MGETR) £4m.

Relief for orchestras came into effect in 2016, and museum and gallery exhibitions tax relief has only been available since 2017, so it is likely that there will be many more claims this year as awareness grows. Nonetheless it is clear that some cultural organisations are failing to spot the potential for a claim.

How does it work?

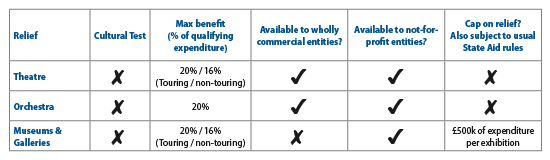

If your organisation is a corporate entity and undertakes activities that include the development of theatrical productions, curation of displays or exhibitions, or development of instrumental concert performances, then it may well be able to make use of the three newest reliefs. With the exception of MGETR, they are all available to commercial as well as not-for-profit undertakings and if your organisation is responsible for the creative aspects of these activities then a claim may be possible.

While reliefs for film and other screen media were aimed at the promotion of only culturally relevant productions and have to pass a ‘cultural test’, this is not true of theatres, orchestras, museums and galleries.

The reliefs allow additional corporation tax deductions that will either reduce taxable profits or, where they create losses, can be surrendered for a repayable tax credit. This is cash for your organisation. Claims are made for each accounting period and must be filed with HMRC within two years of the end of the accounting period.

The financial value of the reliefs can be significant and broadly depends on the level of the ‘qualifying expenditure’. For example, costs that relate to the initial work, such as rehearsals or setting up an exhibition, are considered to be qualifying expenditure, but exhibition running costs and the costs of live performances do not qualify. Complications can arise where there are costs that are incurred for both aspects of the activity.

Different criteria apply for each type of relief, but they are typically worth up to 20% of qualifying expenditure.

Technical barriers

All claims are incorporated into your annual Corporation Tax Returns and you may well need professional assistance as the detailed legislation is complex. This complexity is a result of the rules being based on earlier types of tax relief, which are more commercial and related to producing something for a screen rather than a live performance. The main technical difficulties relate to timings of the relevant stages of a production or exhibition, and identifying which expenditure is qualifying.

But cultural organisations shouldn’t be put off by this. Money is available for claiming and failing to apply may be the only reason they can’t reap the benefits of these important schemes.

There is one thing to note though. All good things come to an end and the MGETR has a sunset clause. This means that it is due to end in April 2022 if it is not renewed by the Government before then.

So, if you believe you might be eligible for this relief, don’t delay. Get your claim in straight away!

Louise Veragoo is Tax Director at haysmacintyre

haysmacintyre.com

This article, sponsored and contributed by haysmacintyre, is part of a series of articles sharing insights into how organisations in the arts and cultural sector can manage their finances to maximise their commercial potential.

Join the Discussion

You must be logged in to post a comment.