Blackpool Winter Gardens saw a 91% increase in ticket sales last year

Photo: Michael D. Beckwith

Audience behaviour: Where do we go from here?

As the Covid aftermath continues to unfold, David Reece explores how audience behaviour has changed and what that means for the way the performing arts shape future success.

Not long ago, I was at a conference talking about how to forecast in a world where everything is changing. I put up a slide which listed five stats about the state of the economic climate.

It started with inflation, expected to fall (good news), but was followed by interest rates increasing (bad news for 6.8m households with a mortgage). Then, household disposable income, down (bad news); household savings, down (bad news); and finally, consumption forecast to fall this year (bad news) but grow next (shrug-of-the-shoulders news).

I realised my audience was looking a bit despairing, prompting me to jest: “Welcome to the AMA (Arts Marketing Association) conference, where you're going to leave thoroughly depressed.”

Sector pressures

Undoubtedly, the past few years have been tough, and the future remains uncertain. But one thing we do know is the theatre industry's resilience is a testament to its enduring spirit.

We shouldn’t take this for granted of course. The pressures the sector faces are clear with senior figures warning: “The precarious funding environment facing theatres and the ongoing impact of the cost-of-living crisis are behind a rise in the number of artistic directors leaving the role.”

Success stories

Amid the challenges, there are still plenty of successes. The Old Vic recently set a new box office record with its musical, Groundhog Day and the National Theatre’s screening of Prima Facie become the highest-grossing event cinema release ever, taking in an impressive £4.47m.

Smaller venues like the Mercury Theatre in Colchester celebrated a record-breaking pantomime earlier this year and Blackpool Winter Gardens saw a 91% increase ticket sales in 2022-23 and its first ever £500k show with the musical Six. And last year, according to UK Theatre, overall theatre attendances were up 7.21% from 2019.

Entertainment spend growing

According to Barclaycard’s consumer spending report, in July, entertainment had another good month with “strong spend growth of 15.8%… the highest month year-on-year seen since January 2023”.

This is nearly four times higher than the 4.0% average consumer card spend and more than double the rate of inflation that month at 6.8%.

All of which points to the fact that people are still prepared to spend on experiences even if they’re cutting back elsewhere.

Consumer confidence remains precarious

Inflation continues to fall from its peak, albeit at a slower rate than expected, with the Bank of England forecasting a decrease to around 5% by the end of the year and a return to its 2% target by early 2025.

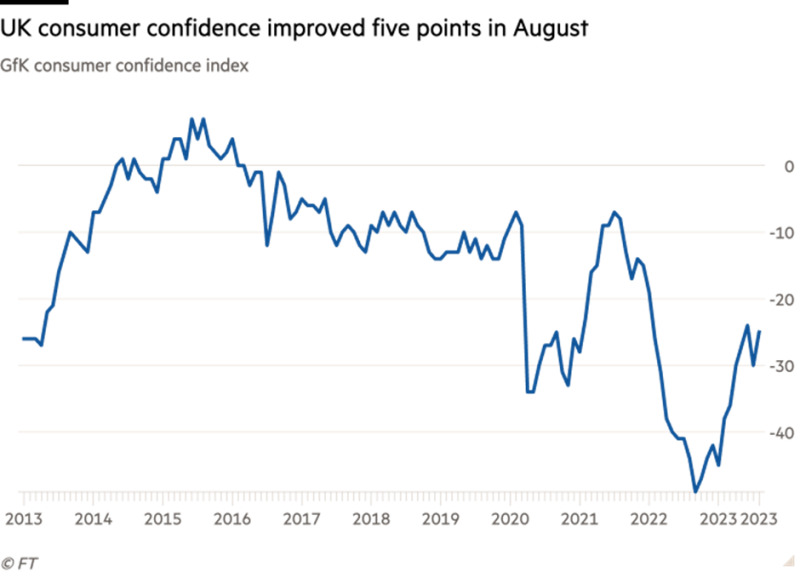

Which is broadly good news but, after so much uncertainty and financial turmoil, many people are still far worse off than pre-pandemic, with higher borrowing costs and ongoing price rises resulting in UK consumer confidence seesawing all over the place, falling in July – after being on the rise since January – and marginally recovering in August.

Consumer confidence is a key indicator of consumer spending, as evidenced by the continued growth in entertainment spend since the start of the year. But having taken such a big hit to fall to an all-time low at the end of last year, it remains precarious.

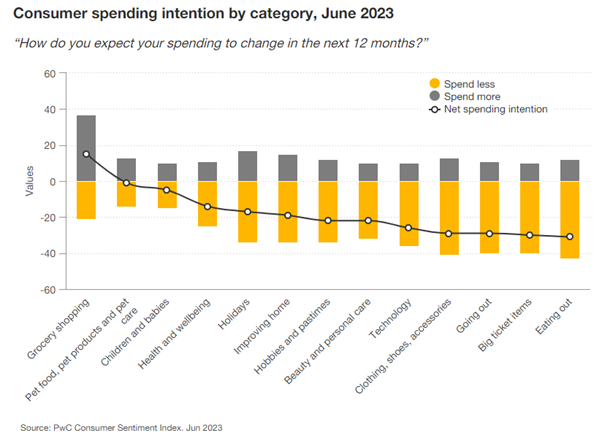

We should also be aware that according to PWC’s consumer spending intention report from June, the only category where more people expect to spend more – their net spending intention – is grocery shopping, simply because food inflation is so high.

So, while entertainment spend is up, people don’t expect to spend more which suggests entertainment spend is more likely spontaneous and driven by a desire not to miss out. This is also evidenced by a shift to later booking patterns.

Frequency is down

Going out is way down the list of spending priorities at third from bottom, just above big-ticket items and eating out. The outcome of which is a drop in frequency, as reflected in The Audience Agency’s cultural participation monitor, which found more than a third of audiences are attending fewer arts and cultural events compared with before the pandemic.

At Baker Richards, we’ve found this decline is primarily driven by fewer frequent attendees, emphasising the vulnerability of organisations reliant on a smallish group of dedicated patrons – a trend which is already hitting US theatres hard.

Increased volatility

One of the consequences is increased sales volatility with some, mostly ‘safe’, productions selling strongly, those appearing to guarantee a good time and so are worth spending money on, while other shows struggle without such high amounts of ticket buying from the core audience.

On the plus side, there’s been an increase in the number of overall bookers, especially new bookers, which is encouraging. Although they are less inclined to take risks (at the moment) and they are less frequent (at the moment), they are prepared to spend money on shows they want to see, offering opportunities for future engagement and growth.

Experiment and adapt

If the old model is broken – and our work shows the numbers don’t stack up by simply reverting to old ways – then what does the new model for the future look like?

Just keep programming hits and everything will be fine? While programming is fundamental to box office success, theatre would lose that vibrancy which gives the world deeper richness and meaning if no-one ever strayed from the tried and tested to take risks and make bold decisions.

Yes, some might fail, but only by deepening relationships with audiences and taking them with you can organisations take those necessary leaps of faith, a willingness to experiment, an acceptance that you won’t get everything right all the time, but the space to play, learn, and grow.

As the writer, Ray Bradbury puts it: “Life is about trying things to see if they work.” To do that, organisations need the support and trust of everyone in their ecosystem – board members, staff, audiences and funders – alongside a framework to experiment and adapt, responding to uncertainty and reassessing what future success looks like.

David Reece is Deputy Chief Executive at Baker Richards.

![]() www.baker-richards.com

www.baker-richards.com

![]() @BakerRichards | @davidnreece

@BakerRichards | @davidnreece

This article, sponsored and contributed by Baker Richards, is part of a series sharing insights into how organisations in the arts and cultural sector can achieve their commercial potential.

Join the Discussion

You must be logged in to post a comment.